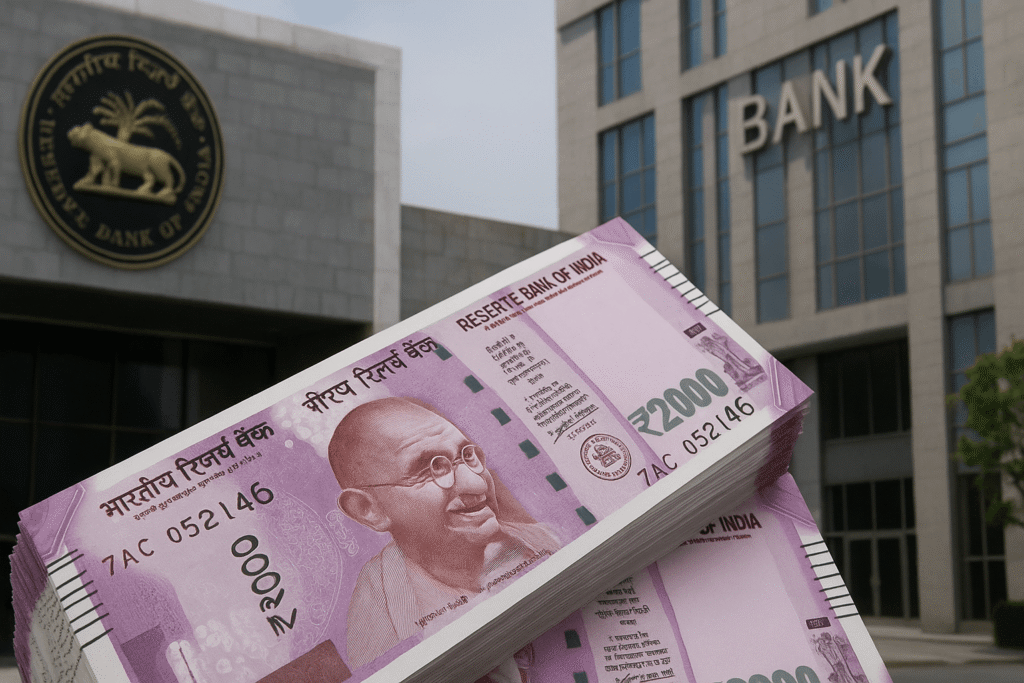

New Delhi: The Reserve Bank of India (RBI) has announced that circulation of ₹2000 notes has fallen sharply to ₹5,884 crore as of 30 September 2025. The figure marks a steep decline from nearly ₹3.56 lakh crore in May 2023, when the central bank announced the gradual withdrawal of these high-denomination notes.

Why Circulation Dropped

The reduction follows RBI’s 2023 directive urging citizens to deposit or exchange ₹2000 notes. Initially, this facility was available at all banks until 7 October 2023, after which it was restricted to 19 RBI regional offices and selected post offices.

Background of the ₹2000 Note

- Introduced in November 2016 post-demonetization, to ease cash shortages.

- RBI stopped printing the notes in 2018–19.

- Most notes in circulation were issued before March 2017, and their aging further pushed RBI to phase them out.

Current Status

Despite the decline, the ₹2000 note remains legal tender and continues to serve important functions:

- Loan repayments and large-value transactions.

- Bank deposits, aiding liquidity.

- Legal settlement of debts, ensuring ongoing validity.

However, their use in daily retail and market transactions has virtually vanished, with many merchants reluctant to accept them.

Expert View

Financial experts advise individuals to deposit or exchange their remaining ₹2000 notes sooner rather than later to avoid inconvenience, as acceptance in regular commerce continues to shrink.

Bottom Line

The circulation of ₹2000 notes may be rapidly shrinking, but they remain a banking gamechanger for high-value settlements and liquidity. With RBI maintaining their legal status while steering the economy toward smaller denominations, the phase-out underlines India’s evolving cash management strategy.

Originally published on 24×7-news.com.