Foreign Inward Remittance Statement (FIRS) for YouTube Revenue in India

Earning money from YouTube is an exciting milestone for creators. Whether it’s through AdSense ads, Super Chats, channel memberships, or brand integrations, the payments you receive from Google are usually processed in US Dollars (USD) and credited to your Indian bank account. Since this money comes from outside India, it is considered a foreign inward remittance, and banks in India classify it accordingly.

This is where the Foreign Inward Remittance Statement (FIRS) comes into play. If you are a YouTuber or digital creator in India, understanding FIRS is important for compliance, tax filing, and financial documentation.

What is FIRS (Foreign Inward Remittance Statement)?

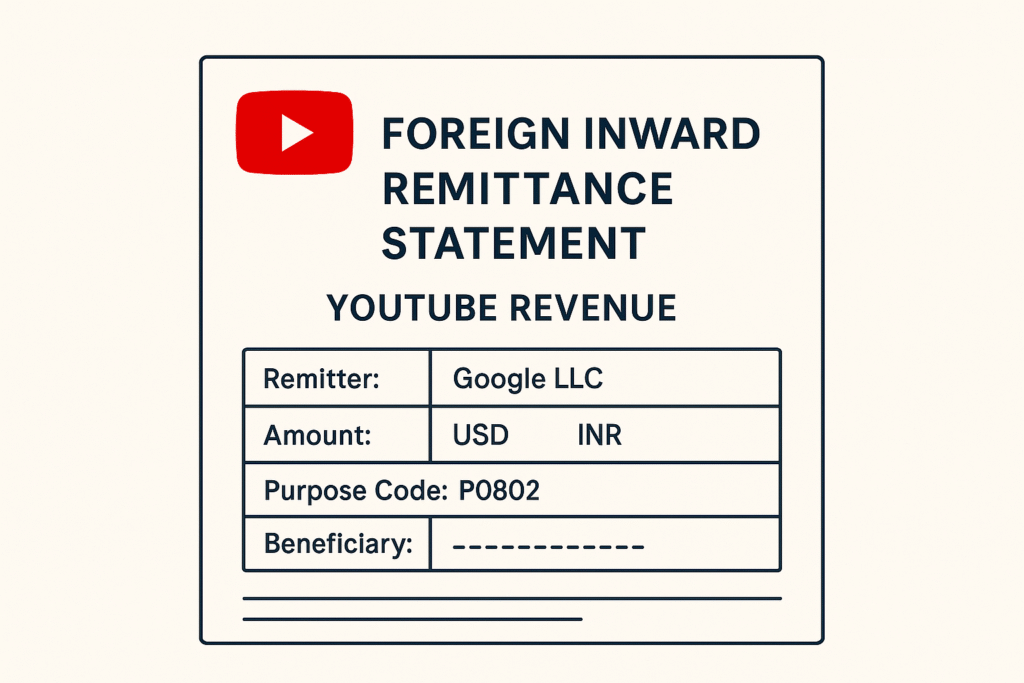

FIRS is a certificate/statement issued by your receiving bank in India. It confirms that the funds credited to your account were received from abroad and provides key details such as:

- Name of remitter (Google LLC or Google Asia Pacific)

- Amount received in foreign currency (USD)

- Converted amount in INR (credited to your account)

- Transaction reference number (UTR)

- Date of credit

- Purpose code (e.g., P0802 – Advertising, IT & Software services)

Earlier, banks issued FIRC (Foreign Inward Remittance Certificate), but most banks now provide FIRS in a digital format.

Why YouTubers Need FIRS

As a YouTube creator, you might wonder why FIRS matters. Here are some reasons:

- Tax Compliance – Income from YouTube is taxable in India. FIRS helps as proof of foreign earnings during GST or income tax assessments.

- Business Proof – If you operate as a sole proprietor, freelancer, or registered company, FIRS acts as valid proof of foreign revenue.

- Export Incentives – Some businesses claim government benefits for export of services; FIRS may be required to avail such schemes.

- Loan & Funding Applications – When applying for business loans or startup funding, banks and investors often ask for FIRS as evidence of genuine foreign income.

How to Get FIRS for YouTube Revenue

Google/YouTube does not directly provide FIRS. Since the money is routed through AdSense payouts to your Indian bank, your bank is the only authority that issues the document.

Here’s a step-by-step process:

- Identify the Payment – Log in to your bank account and find the YouTube/Google AdSense credit entry. Note down the UTR number (unique transaction reference).

- Contact Your Bank – Reach out to your bank’s branch or forex department. Many banks like HDFC, ICICI, Axis, Kotak, and SBI have dedicated remittance desks.

- Provide Details – Share UTR number, date, and amount of the transaction. Some banks may ask for your AdSense payment advice (available in your Google AdSense account under “Payments”).

- Receive FIRS – Depending on your bank, you may get:

- A PDF FIRS via email, or

- Download access via internet banking/trade portal, or

- A physical copy (rare nowadays).

Example – How Banks Handle FIRS

- HDFC Bank: Issues digital FIRS via their ADMAK system.

- ICICI Bank: Allows FIRS downloads through Trade Online portal.

- SBI & Kotak: Usually provide FIRS on request via the forex/branch department.

Key Points to Remember

- FIRS is not generated by YouTube or Google, but by your bank.

- Always use the correct purpose code (P0802) for advertising and software export revenue.

- Keep a record of all FIRS for smooth tax filing and compliance.

Final Thoughts

If you are a YouTube creator earning in India, obtaining a Foreign Inward Remittance Statement (FIRS) is an essential step in managing your revenue. It not only ensures transparency with tax authorities but also strengthens your credibility as a professional content creator earning legitimate foreign income.

Make it a habit to request your FIRS from your bank every time you receive an international payment from YouTube. It will save you time, effort, and potential compliance headaches in the future.