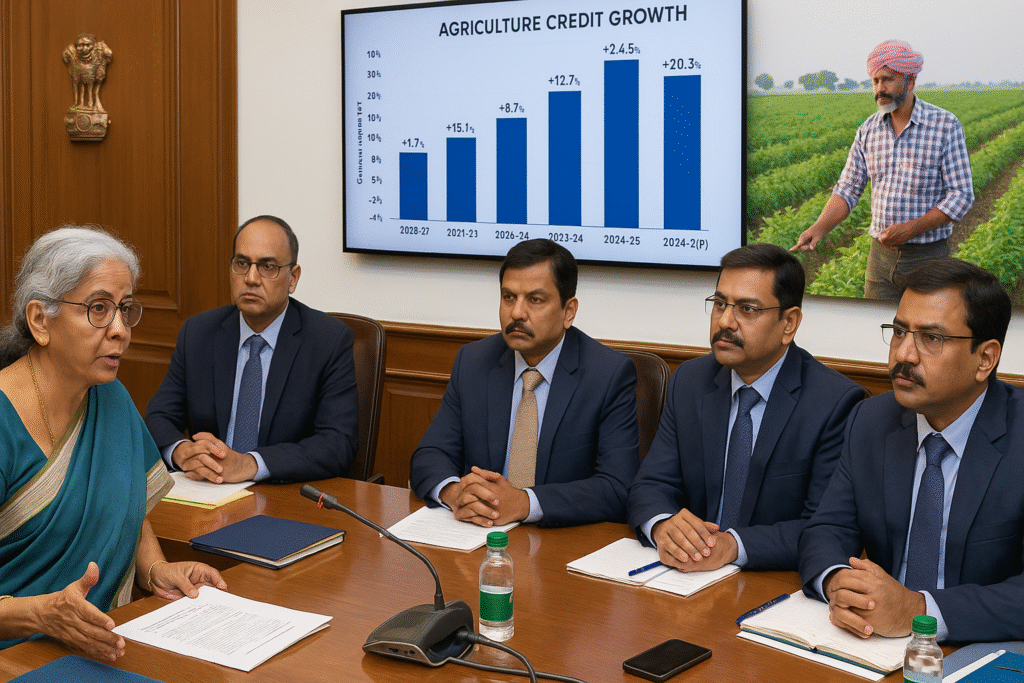

New Delhi: Union Finance Minister Nirmala Sitharaman has called on rural and regional banks to enhance agricultural credit disbursement to meet the growing needs of India’s evolving rural economy. The minister made the remarks while reviewing the performance of Karnataka Grameena Bank (KaGB) in a high-level meeting held on Thursday.

The meeting was attended by Department of Financial Services (DFS) Secretary M. Nagaraju, NABARD Chairman Shaji K. V., and other senior officials from the Finance Ministry.

Focus on Agro Credit and Allied Sectors

During the review, Sitharaman assessed key performance indicators including credit growth, Non-Performing Assets (NPAs), financial inclusion, and the implementation of government-sponsored schemes by KaGB.

She urged the bank to increase its share in agricultural credit disbursement, particularly focusing on emerging sectors such as agri-tech, food processing, and allied agricultural activities.

“KaGB and Canara Bank should work closely with state government departments to enhance credit disbursement to MSMEs and allied sectors,” the Finance Ministry statement noted.

Capital Support for Farmer-Producer Organisations (FPOs)

Highlighting the importance of Farmer-Producer Organisations in strengthening India’s rural economy, Sitharaman said while their capital needs are often met by government departments or development finance institutions, their working capital requirements must be addressed by banks.

She emphasized that rural banks should modernize their loan products and services to align with FPOs’ evolving business models. This, she added, would enable sustainable rural growth and mutual benefit for both banks and producers.

Leveraging Emerging Opportunities in Tier-2 and Tier-3 Cities

Sitharaman also pointed out that several companies are relocating data centres and service operations to tier-2 and tier-3 cities, presenting new credit opportunities for rural banks. She urged KaGB to tap into these trends to strengthen its balance sheet and profitability.

The minister further said that the rationalisation of GST rates and rising rural consumption have opened fresh business prospects for rural financial institutions.

Improving Outreach and Scheme Implementation

Sitharaman advised KaGB and its sponsor Canara Bank to collaborate with panchayat and district-level committees to enhance the screening of loan applications under key central government schemes such as PM Vishwakarma and PMFME (Pradhan Mantri Formalisation of Micro Food Processing Enterprises).

She also directed KaGB to expand its footprint in the Kalyana Karnataka region, especially in underserved areas, and to focus on:

- Improving asset quality

- Adopting modern banking technologies

- Enhancing customer service delivery

Driving Financial Inclusion and Rural Prosperity

By urging regional banks to boost agricultural lending, support FPOs, and leverage digital infrastructure, Sitharaman reinforced the government’s vision of inclusive growth through stronger rural credit systems.

With over 33% of India’s population dependent on agriculture, the push for increased credit flow is expected to fuel rural entrepreneurship, productivity, and job creation across the agricultural value chain.

Originally published on newsworldstime.com.

Originally published on 24×7-news.com.