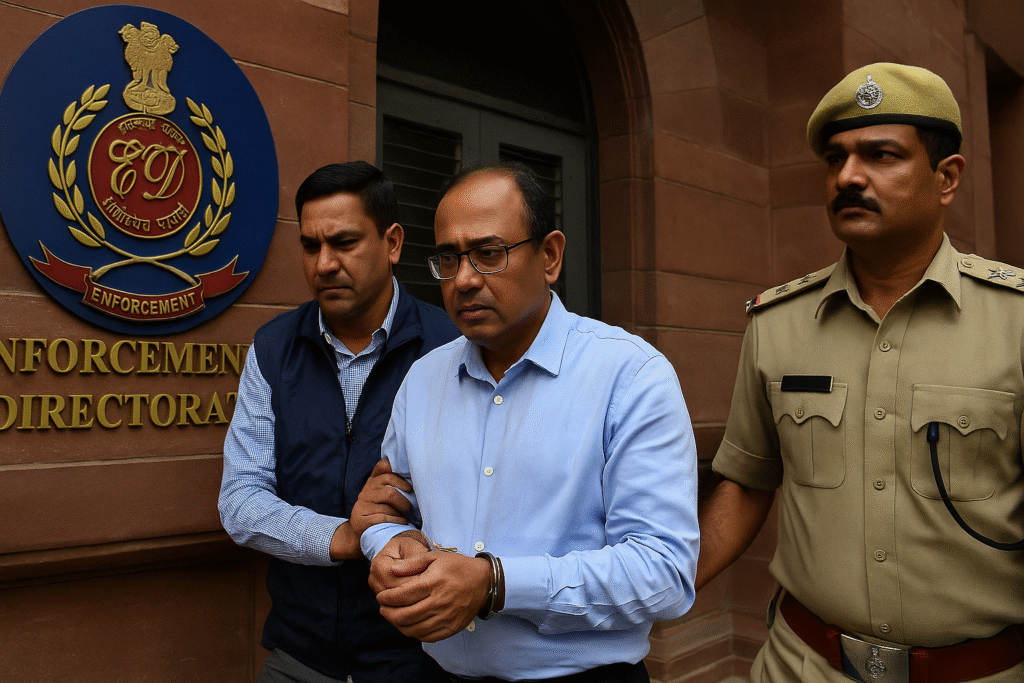

In a major development, the Enforcement Directorate (ED) has arrested Ashok Pal, the Chief Financial Officer (CFO) of Reliance Power, in connection with a money laundering case involving a fake bank guarantee worth ₹68 crore. The arrest marks a significant step in the agency’s probe into an alleged financial fraud involving Reliance NU BESS Limited, a subsidiary of Reliance Power.

ED Arrests Reliance Power Executive

According to sources, Pal was taken into custody late Friday night under the Prevention of Money Laundering Act (PMLA) after hours of interrogation.

He will be produced before a special PMLA court in Delhi, where the ED is expected to seek custodial remand for further questioning.

The probe centers on a ₹68.2 crore bank guarantee submitted to the Solar Energy Corporation of India Limited (SECI) on behalf of Reliance NU BESS Limited, which has been deemed fake by investigators.

Fake Bank Guarantee Case

The fake guarantee was allegedly issued from FirstRand Bank in Manila, Philippines, even though the bank has no operations in the region, according to the ED. The guarantee was part of a bid submission for SECI’s Battery Energy Storage System (BESS) tender.

Investigators say that the company’s board had authorized Ashok Pal to finalize and approve all documents for the SECI tender, leveraging Reliance Power’s financial credentials.

Link to Biswal Tradelink and Earlier Arrests

The case traces back to Odisha-based Biswal Tradelink, which is accused of providing fake bank guarantees to various companies for a commission of 8%.

In August 2025, the ED had arrested Partha Sarathi Biswal, Managing Director of Biswal Tradelink, and conducted searches at multiple premises linked to the firm and its associates.

According to the agency, Biswal Tradelink functioned as a “paper entity,” with its registered office located in a residential property belonging to one of Biswal’s relatives.

Fraudulent Emails and Forged Documents

The ED also discovered that the Bhubaneswar-based company used a fake email domain (s-bi.co.in) resembling the State Bank of India (SBI) domain to mislead SECI officials and make the communications appear legitimate.

Forged documents and email communications were allegedly sent via this domain, and Pal reportedly approved and facilitated certain transactions through Telegram and WhatsApp, bypassing official corporate channels.

Reliance Group’s Response

In a statement, a Reliance Group spokesperson clarified that Reliance Power is a victim of a larger conspiracy involving fraud, forgery, and cheating.

The company said it had reported the matter to the Economic Offences Wing (EOW) of the Delhi Police in October 2024, and also disclosed the fraudulent activity to the stock exchanges on November 7, 2024.

“The company has cooperated fully with authorities and will continue to follow the due legal process,” the statement added.

Background of the Case

The ongoing money laundering probe stems from an FIR filed by the EOW in November 2024, accusing Biswal Tradelink and its associates of issuing fake bank guarantees to multiple entities for hefty commissions.

The ED suspects the proceeds were laundered through shell firms, prompting a deeper financial trail investigation involving corporate and personal accounts.

Originally published on newsworldstime.com.

Originally published on 24×7-news.com.