India is preparing for one of its most significant tax reforms in over six decades as a new Income Tax law is set to come into effect from April 1, 2026. The change will replace the existing Income Tax Act of 1961, which has long been criticized for its complexity, frequent amendments, and difficult legal language.

The introduction of the new law aims to make tax compliance simpler, more transparent, and easier for ordinary taxpayers by cutting down on confusing sections, simplifying definitions, and modernising return filing procedures.

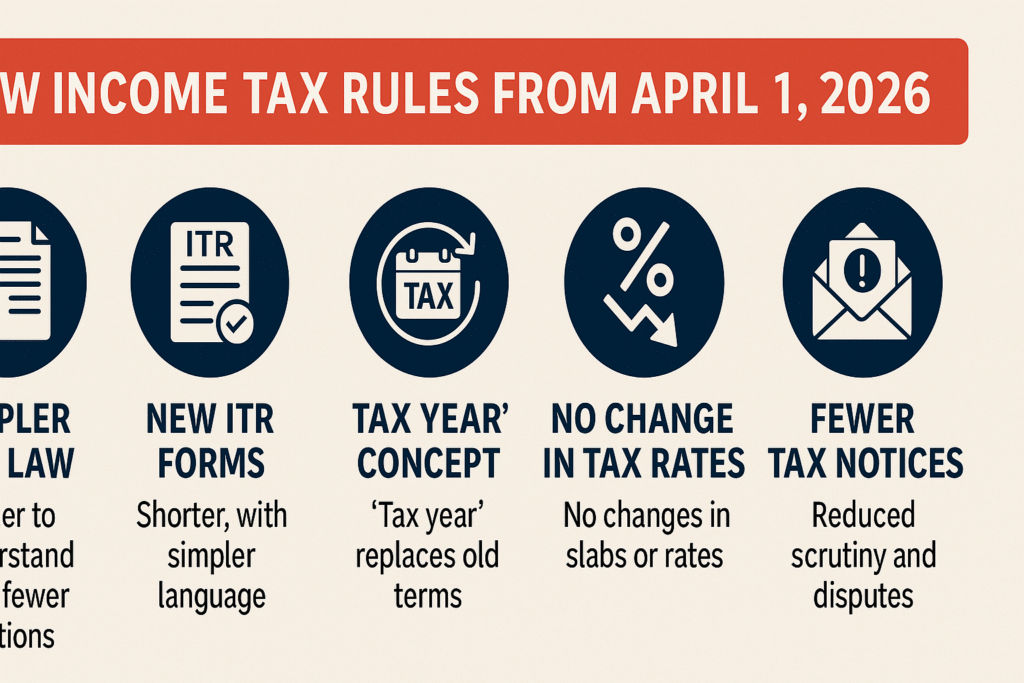

Here are the five major changes that will redefine how taxpayers interact with the Indian tax system.

1. Simpler and Shorter Income Tax Law

The current Income Tax Act contains 819 sections, multiple schedules, and complicated legal language that most citizens struggle to understand.

The new law:

- Cuts down the number of sections

- Uses simpler, easy-to-understand language

- Removes outdated provisions

- Makes it easier for taxpayers to understand obligations without relying on experts

The government’s aim is clear — improve compliance by reducing complexity.

2. New, Simplified ITR Forms

Taxpayers have long complained about complicated and repetitive Income Tax Return (ITR) forms.

The new system will introduce completely redesigned ITR forms that are:

- Shorter

- Easier to understand

- Free from unnecessary schedules

- Pre-filled with more detailed information

- Simple to verify

This will benefit everyone — salaried individuals, small businesses, and freelancers — making return filing less stressful and less time-consuming.

3. Introduction of a New ‘Tax Year’ Concept

The old system used Previous Year and Assessment Year, confusing millions of taxpayers.

Under the new rules:

- One unified Tax Year will replace old terms

- Earnings, taxation, and filing will fall under a single, clearer system

- Tax calculations and deadlines will become more intuitive

This modernized approach brings India in line with more globally recognized tax structures.

4. No Change in Tax Slabs or Rates

Despite expectations, the government has not changed any tax slabs, rates, surcharges, or cess.

The focus of the new law is strictly on simplification, not taxation.

For taxpayers, this means:

- No surprise increase in tax burden

- No changes in existing financial planning

- A stable and predictable tax environment

5. Fewer Notices and Lower Tax Disputes

Ambiguity in the old law often led to:

- Incorrect notices

- Preventable disputes

- Lengthy interactions with tax departments

The new law aims to:

- Remove unclear provisions

- Strengthen the faceless assessment system

- Digitise and standardise notices

- Reduce unnecessary scrutiny

This will build greater trust and confidence between taxpayers and authorities.

Conclusion

The tax changes coming into effect from April 1, 2026, mark the beginning of a new era in India’s tax administration. After 63 years, the country is finally moving to a cleaner, simpler, and more transparent system designed around the needs of the common taxpayer.

The new framework promises:

- Easier compliance

- Simpler language

- Smarter return filing

- Fewer disputes

For taxpayers, filing returns will no longer feel like deciphering legal codes — it will be a streamlined and more accessible process for all.

Originally published on 24×7-news.com.